How does AfterPay make money?

Are you curious about how AfterPay and similar buy now pay later businesses make money? Wondering how they can afford to offer such great deals?

In this blog post, we’ll take a closer look at how these companies operate, and how they manage to turn a profit. We’ll also explore some of the benefits of using a buy now pay later service, and how it can help you save money. Stay tuned!

What is AfterPay and how does it work?

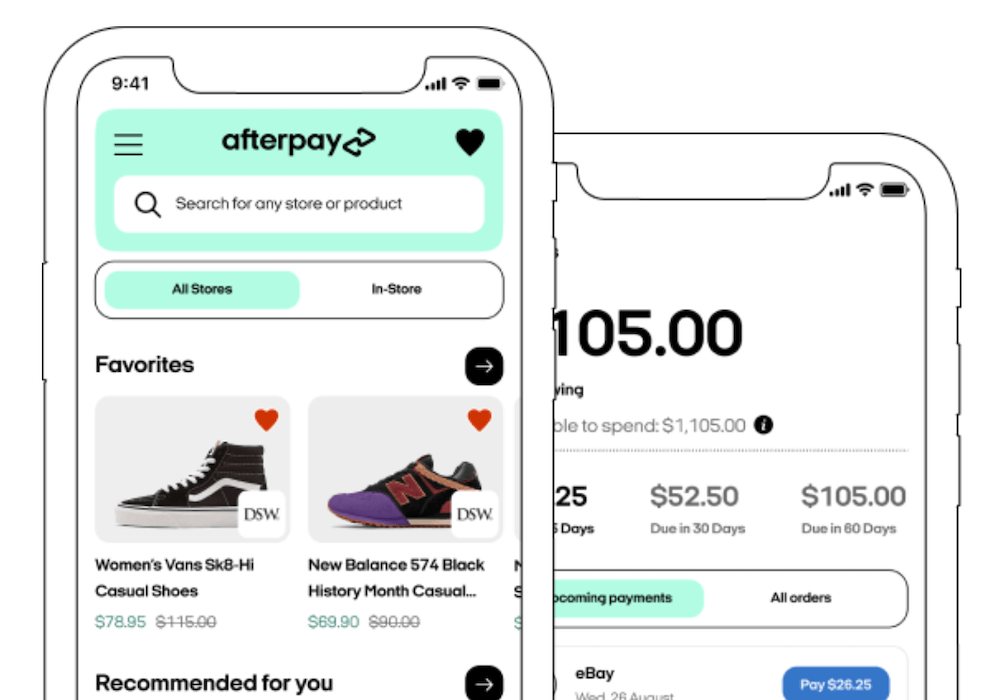

AfterPay is a service that allows you to shop now and pay later. It’s perfect for online shopping, as you can spread the cost of your purchase over 4 interest-free installments. You’ll only ever pay the price of the item – there are no hidden fees or charges.

To use AfterPay, simply select it as your payment method at checkout. You’ll then be prompted to enter your personal and payment details. Once your first installment is complete, your order will be processed and shipped out to you right away.

You’ll then have 14 days to pay off the remaining balance. If you need more time, you can make partial payments or even extend your due date (for a small fee). As long as you make your payments on time, there’s no interest or added fees – it really is that simple!

How does AfterPay make money?

AfterPay makes money by charging merchants a small fee for every transaction. They also charge customers a late payment fee if they miss a payment or extend their due date.

These fees are how AfterPay generates revenue, and how they can afford to offer such great deals. They charge merchants a small fee for every transaction charging a small fee per transaction, AfterPay is able to generate enough revenue to cover their costs and still make a profit.

Also read: How does Klarna make money?

The benefits of using AfterPay

There are many benefits of using AfterPay, both for shoppers and merchants.

For shoppers, AfterPay provides a simple and convenient way to pay for online purchases. It also offers flexibility and control, as you can choose how and when you want to pay. Plus, there’s no interest or added fees as long as you make your payments on time.

For merchants, AfterPay can help increase sales and conversion rates. It also provides a great alternative payment option for customers who may not have access to credit cards or other traditional forms of payment.

Overall, AfterPay is a win-win for both shoppers and merchants!

How to use AfterPay

If you’re ready to start using AfterPay, simply select it as your payment method at checkout. You’ll then be prompted to enter your personal and payment details. Once your first installment is complete, your order will be processed and shipped out to you right away.

You’ll then have 14 days to pay off the remaining balance. If you need more time, you can make partial payments or even extend your due date (for a small fee). As long as you make your payments on time, there’s no interest or added fees – it really is that simple!

Alternatives to AfterPay

If you’re looking for alternatives to AfterPay, there are a few other options available.

One option is Klarna, which offers similar terms and conditions as AfterPay. Another option is QuadPay, which allows you to split your purchase into 4 interest-free payments.

There are also a few store-specific options available, such as ZipPay (which is offered by a number of Australian retailers) and LayBuy (which is offered by some New Zealand retailers).

Overall, AfterPay is a great option for online shopping. It’s simple, convenient, and flexible, and it’s a great way to spread the cost of your purchase. If you’re looking for alternatives, be sure to check out Klarna, QuadPay, zipPay, or LayBuy.